B2B digital disruption: A quiet revolution

Thursday 29 October 2020Article

Consumer Goods companies don’t need to be told that digital technology is disrupting their business model. Though as a side note, I apologise on behalf of the consulting community, who clearly haven’t fully accepted this yet.

Digital has been on corporate agendas for years, and the impact of Covid is only accelerating this, with businesses rushing to bring forward investments across a range of capabilities that can help them win (or at least not lose) in the new digital environment.

But to date the discussion has largely centred on consumer facing topics, such as online marketing or the rise of direct-to-consumer channels. Further up the supply chain, the less ‘glamorous’ world of business-to-business (B2B) sales has been largely overlooked. But suppliers, wholesalers and distributors have quietly started their own digital revolution – which in some parts of the world is already well underway.

Many of the capabilities needed to win with digital consumers are the same as those required for success in B2B channels, including online order and payment systems, small order picking, last mile delivery, data collection and analysis, the ability to target and tailor marketing messages and promotions.

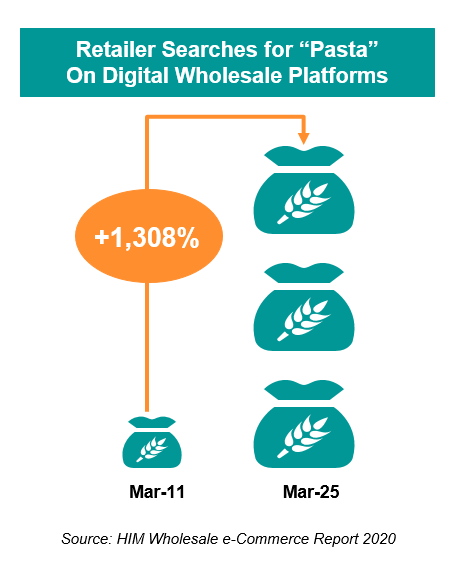

Similarly, the impact of Covid on the B2B sector may not be so different. It is not only end consumers who have undergone a step change in their digital skills – after all, other players in the value chain are usually humans too. As one example, searches on digital wholesaler platforms in the UK leapt by over 1000% in just a few days as the country locked down. While these platforms had already been growing, Covid has intensified the rate of development.

This wouldn’t be the first time a virus helped alter a route to market (RTM) landscape. Alibaba, China’s leading B2B platform, grew by 50% during the SARS outbreak in 2003. Both as international suppliers looked for new ways to sell their products and as Chinese customers became accustomed to purchasing online.

Now, Alibaba is the leading player in an ever-growing and increasingly complex B2B ecosystem in China. In 2018 B2B E-Commerce Gross Merchandise Value in China passed 23 Tr Yuan; APAC may make up 65% of the world’s B2C e-commerce, but in B2B this number is closer to 80%.

China may be ahead of the game, but the rest of the world is beginning to wake up. As they should: the potential size of prize is huge given the scale of current RTM inefficiencies, across a vast array of outlet types be they independent grocers, traditional trade stores, or a broad range of other outlets such as cafes, hotels, schools, salons and beyond.

Imagine a future where as a supplier you could:

- Access a vast array of outlets online, reducing the need for ‘feet on the street’ acquisition

- Tailor marketing and promotions according to outlet and catchment type, then assess the effectiveness of these campaigns with real time sales data

- Assist outlets with ranging and pricing to help maximise profits

- Support the above with a laser focused field force team, smaller in size but more effective

This kind of world would help brands re-forge relationships with usually forgotten outlet types. It would unlock new opportunities in both existing and new channels (including ones currently too costly or difficult to access effectively). Quite likely creating a whole new route to market ecosystem, with a completely different set of key players.

Already there are three main types of model emerging in the B2B landscape globally:

1. Distributors getting digital: ‘Old school’ wholesalers and distributors are investing in digital capabilities and attempting to provide a more holistic offering to their customers

Example: Leading Polish Wholesaler Eurocash already has a website that enables order and delivery for its customers throughout Poland. Last year it announced the launch of a digital marketplace which would increase its product offering from c.11k to c.500k SKUs

2. Next generation’ intermediaries: New and agile digital platforms entering and disrupting the market, without the burden of legacy infrastructures and operating models

Example: Udaan is an online B2B marketplace in India that brings wholesalers, retailers and manufacturers together on a single platform and is used by 3m end outlets. Its app provides a wide range of products, fast delivery (1-2 days) and, crucially for small outlets, credit financing

3. Self-driving suppliers: Suppliers unwilling to wait for intermediaries to evolve are investing in their own solutions

Example: Coca Cola’s connected coolers use IoT technology to collect data on temperature, lighting, energy use, product placement, stock levels and customer behaviour

Whilst a perfectly ‘data-led’ future may sound fanciful, it is clear the ecosystem is evolving. Suppliers should be thinking now, and holistically, about how best to future-proof. The winners will no longer only be those with enough scale to justify a large RTM machine. As barriers to entry decline, the players with access to the right data and capabilities will be in prime position to disrupt the status quo.